Biodiversity conservation has become a national initiative as domestic and international policies progress steadily. E Fund, in collaboration with the International Institute of Green Finance (IIGF) Central University of Finance and Economics, published Biodiversity Risks in Asset managers: From Theory to Practice in the recently released Caixin China ESG Development White Paper 2024. This study conducts a quantitative analysis of the biodiversity risk exposure and risk management of asset managers, and designs a comprehensive assessment and measurement model for biodiversity risks of asset managers.

01 Pathways for Financial Institutions in Biodiversity

The Global Pattern of Biodiversity is Gradually Taking Shape

The international community has made positive efforts in biodiversity conservation. In 2014, the U.S. Agency for International Development (USAID) released the USAID Biodiversity Policy, providing macro-level strategic guidance and a clear action plan for U.S. biodiversity assistance. In the same year, the UK Foreign and Commonwealth Office (FCO), the Department for Environment, Food and Rural Affairs (DEFRA), and the Department for International Development (DFID) jointly released the UK Overseas Territories Biodiversity Strategy. The strategy outlines the UK government's expectations and goals for ensuring biodiversity conservation and development in the overseas territories. It supports this with case studies, such as providing “tools to assess the value of ecosystem services for sustainable development”. The European Commission released the 2030 Biodiversity Strategy on May 1, 2020. It clearly outlines strengthening ecosystem and biodiversity capacity building as a key direction for recovery and addressing future threats.

In China, biodiversity conservation has become a national initiative. China has begun systematically developing mechanisms for biodiversity conservation since the formal signing of the Convention on Biological Diversity in June 1992. The Ministry of Ecology and Environment in January 2024 released the China Biodiversity Conservation Strategy and Action Plan (2023–2030), passing a series of major policies and plans for biodiversity protection. Financial institutions, responding to the United Nations Convention on Biological Diversity, actively participate in biodiversity conservation through innovative financial tools and services. Through joint signing initiatives such as the Biodiversity Finance Pledge, they provide financial support for biodiversity conservation.

Financial institutions are integrating biodiversity considerations into risk-opportunity analyses, while pioneering financial instruments that advance ecosystem stewardship. According to the Convention on Biological Diversity report published by the United Nations Environment Programme in 2021, as well as special research statistics, the overall funding requirement for the global biodiversity framework after 2020 is estimated to be about USD800 billion per year, with an annual funding gap of approximately USD700 billion. Through innovative financial tools and services, financial institutions actively participate in biodiversity conservation, jointly signing initiatives such as the Biodiversity Finance Pledge to provide financial support for biodiversity protection. The aim is to leverage financial support to achieve eco-friendly, sustainable, green, and inclusive development, building a harmonious coexistence between humans and nature for a better Earth.

The Urgency of Biodiversity Risk Analysis from Financial Institutions

Financial institutions need to establish risk management mechanisms with objectivity and prudence to address biodiversity-related physical and transition risks, ensuring their stable operations. As global attention to biodiversity grows, a series of policies to protect natural ecosystems and biodiversity have been introduced, exerting varying degrees of impact on financial market participants. Financial institutions shall take measures to incorporate biodiversity into their risk management frameworks in order to mitigate the impact of biodiversity risks. Active exploration of methods for quantifying and assessing biodiversity risks, along with the establishment of risk monitoring and early warning mechanisms, ensures the timeliness and effectiveness of risk management.

Biodiversity risk management mechanisms help financial institutions select high-quality investment targets and lead capital flows toward biodiversity conservation-related areas, aligning with sustainability goals. Over 170 financial institutions globally have signed the Biodiversity Finance Pledge, committing to protect biodiversity through financing and investment activities. Financial institutions should prioritize projects with a positive impact on biodiversity conservation, which bring economic benefits to local communities while improving the ecological environment, thus achieving a win-win for ecological and economic benefits. Additionally, biodiversity risk management mechanisms in financial institutions can help investors avoid projects that may cause irreversible damage to natural capital, advancing the Sustainable Development Goals (SDGs).

Financial institutions shall ground their operations in risk stewardship, harness innovative financing mechanisms to close biodiversity funding gaps, pioneer nature-positive investment vehicles, and convert ecological risks into value-creation opportunities. Currently, major financial institutions have been developing projects supporting forestry, sustainable agriculture, fisheries, and ecological restoration to advance biodiversity conservation. In November 2022, the Paris Branch of the Bank of China issued its first US dollar-denominated biodiversity-themed green bond, with an issuance size of USD400 million—the first of its kind in Europe. The innovation of biodiversity-related products by financial institutions not only helps drive biodiversity conservation and restoration but also create new business growth opportunities for a sustainable development.

02 Biodiversity Risk Analysis Methods for Asset Managers

This study conducts a quantitative analysis of risk exposure and risk management to develop a comprehensive assessment model for biodiversity risks in asset managers. The model focuses on the quantitative analysis of biodiversity risks in asset managers. It objectively reflects the material factors and their specific degree of impact directly or indirectly related to financial institutions. Additionally, this study analyzes the biodiversity risk management mechanisms and key points for asset managers. By integrating advanced practices and risk management mechanisms of asset managers, the study analyzes the factors to consider, entry points for related work, and innovative approaches in actual operations through typical case studies. This study, based on the research findings from the analytical methodology, focuses on analyzing the core aspects of how Chinese asset managers are addressing biodiversity risks, supporting ecological restoration and environmental protection, and promoting the development of biodiversity finance. The study aims provide valuable insights to the capital market.

Analytical Approach

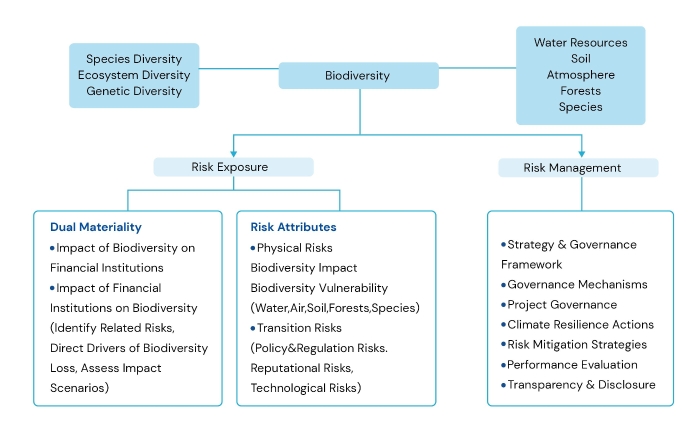

In international biodiversity conservation policy documents, the definition of biodiversity includes three components: species diversity, ecosystem diversity, and genetic diversity. Therefore, in the research methodology, the definition of biodiversity risk focuses on the natural resource endowment categories more closely related to the three components. Water resources, soil, atmosphere, forests, and species are identified as the core risk-bearing elements within ecosystems.

The biodiversity risk analysis method for financial institutions’ biodiversity risks is mainly divided into two dimensions: risk exposure and risk management (Figure 1). The risk areas that have not yet been effectively governed are assessed by comprehensively considering the risk exposure of asset managers and the corresponding risk management effectiveness. This enables the evaluation of the effectiveness of biodiversity risk management in asset managers. Risk exposure refers to the impact of biodiversity-related risk factors on the asset manager itself or its investment and financing targets during production, operations, or other business activities, leading to asset impairment losses or other potential negative outcomes. In contrast, using methods such as risk avoidance, risk diversification, risk hedging, or risk transfer, risk management refers to the proactive measures taken by financial institutions to prevent biodiversity risk events and their associated effects.

Figure 1

Biodiversity Risk Quantification Methodology for Asset managers

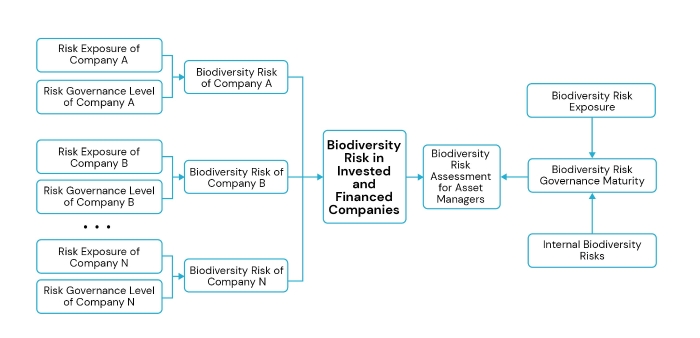

By using the comprehensive assessment and quantification model for biodiversity risks in asset managers, the study measures both biodiversity risk exposure and risk management capabilities. The model objectively reflects the direct and indirect biodiversity risks, substantial impacts, and specific degree of influence on the investment and financing targets of asset managers. The biodiversity risk measurement for investment and financing targets combines the compound analysis of biodiversity risk exposure and biodiversity management levels as illustrated in Figure 2. The risk exposure will comprehensively reflect the portfolio risks, while the management level will indicate the effectiveness of the measures taken by asset managers to mitigate or reduce the associated risks.

Figure 2

Case Study

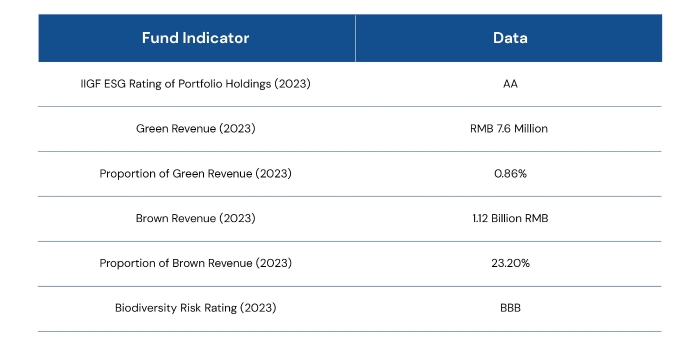

1) Fund Evaluation

Fund A is an equity fund, with primary investments in resource sectors, including integrated oil and gas companies, oil refining, and natural gas processing industries. In terms of sustainable finance risks, Fund A has a biodiversity risk composite rating of BBB and an ESG rating of AA from the International Institute of Green Finance (IIGF) Central University of Finance and Economics. The fund, in terms of green and brown revenue, is gradually shifting towards clean energy and renewable energy resource sectors, with a conscious effort to enhance its green development outcomes.

Source: The International Institute of Green Finance (IIGF), Central University of Finance and Economics

2) Biodiversity Risk Rating for the Fund

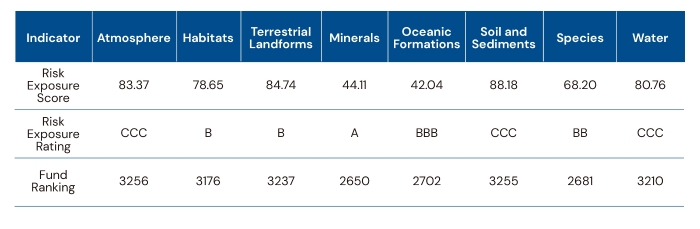

Due to the concentration of themes in the resource industry and the distribution of risks, Fund A has a higher exposure to biodiversity risks. The corresponding biodiversity risks are decomposed into eight core natural capital elements, as shown in table below, with the corresponding risk exposure ratings generally at lower levels (B and CCC). The biodiversity risk exposure rankings for the various types of natural capital involved in the fund are all close to 90%. The risk exposure borne by the atmosphere, water resources, soil, and sediments is the most prominent.

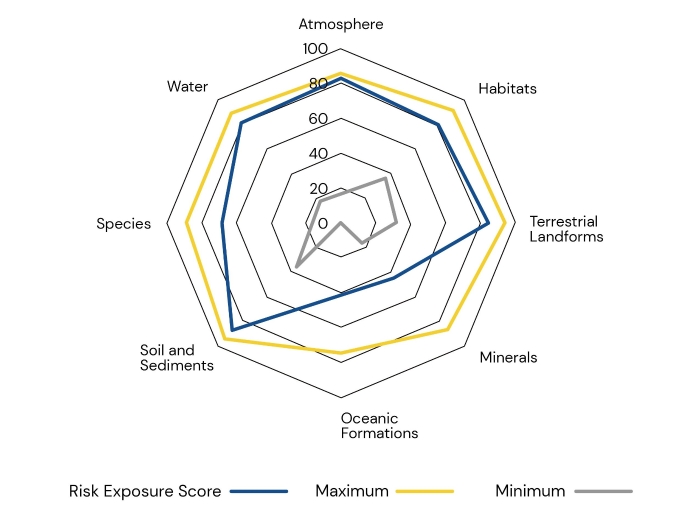

Using a radar chart, the research team analyzed the biodiversity risk exposure levels of the fund across various natural capital dimensions to assess its relative risk exposure position by comparing the fund’s performance with the extreme risk exposure values of its peers. The fund’s risk exposure is at a relatively high level and is distributed fairly evenly as shown in Figure 3. The performance is particularly significant in the atmosphere, soil, and sediment sections. These values are close to the maximum levels among similar funds (85.71 and 94.39, respectively), warranting special attention.

Figure 3

Source: The International Institute of Green Finance (IIGF), Central University of Finance and Economics

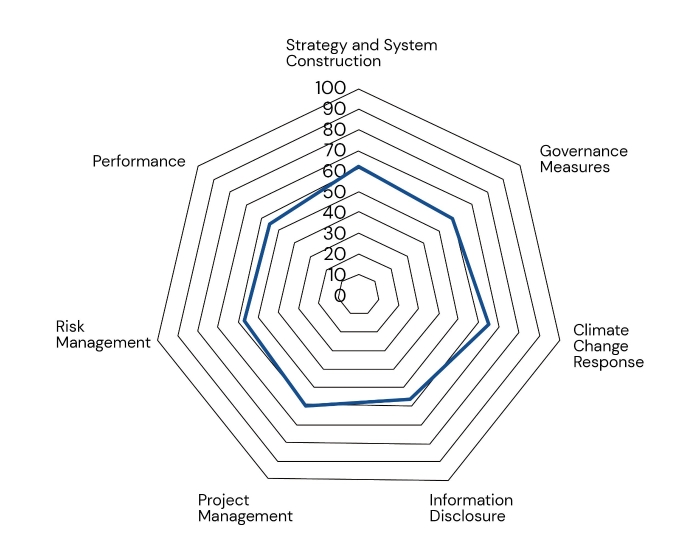

By referring to the biodiversity risk management indicator system of listed companies, the research team analyzed the underlying holdings of fund products across the market. The research team also compiled the overall score for each fund in terms of its performance in relevant risk management. As shown in Figure 4, Fund A’s management score ranks in the mid-range, particularly in strategy and system development (61.24), climate change response (64.54), and project management (59.45). The governance levels in risk management (56.92) and information disclosure (56.63) still need further improvement, considering that the fund’s underlying assets are primarily in the non-ferrous metals and mining industries.

Figure 4

Source: The International Institute of Green Finance (IIGF), Central University of Finance and Economics

3) Biodiversity Risk of the Fund’s Top Ten Holdings

An analysis of Fund A’s top ten holdings shows that its industry breakdown is concentrated in ferrous metals, non-ferrous metals, and mining sectors. The related risks of the fund's holdings are at a relatively moderate level from the perspective of the comprehensive biodiversity rating. Most of the held companies have implemented measures to manage biodiversity risks to varying degrees although the industries of the listed companies in the fund's holdings are generally concentrated in areas with high biodiversity risk exposure. In the future, when optimizing its portfolio, Fund A may consider favoring investment targets with relatively higher comprehensive biodiversity ratings.

Source: The International Institute of Green Finance (IIGF), Central University of Finance and Economics

03 Pathways for Enhancing Biodiversity Risk Management Capabilities in Asset Managers

Quantifying Biodiversity-Related Financial Risks

Asset managers are facing challenges in measuring biodiversity risks, particularly in boundary definition, quantitative methodology, and data governance. Transmitted through the physical and transition risks of natural capital, biodiversity risks can lead to asset impairment in asset managers, financial products, and projects. The challenges in managing biodiversity risks lie in risk identification, quantification, and full-chain analysis similar to climate risks, while the definition of biodiversity risks is the prerequisite for quantitative analysis. Currently, while international tools including TNFD and ENCORE provide some references, there are no clear regulations in China. Each asset manager needs to establish applicable requirements based on its own needs. The measurement of biodiversity risks requires multi-dimensional, chain-linked analysis, systematic quantitative methods, and refined data support.

Establishing a Biodiversity Risk Monitoring Mechanism

It is a necessary measure for asset managers to build a biodiversity risk monitoring mechanism and integrate it into their risk management processes to address related risks. The transmission of biodiversity risks is characterized by phases and links, impacting the natural capital of entire industries and spanning the entire lifecycle of industries and projects. Therefore, it is necessary to establish a dynamic monitoring mechanism that aligns with sustainable development at each stage of investment and financing (pre-investment, investment, and post-investment). Firstly, the risks of different investment portfolios can be measured by utilizing biodiversity impact analysis methods and databases. Secondly, digital tools are used to continuously monitor the risk dynamics of financial products. Investment strategies are adjusted, and the portfolio is optimized based on the monitoring data. Thirdly, the comprehensiveness and timeliness of biodiversity data for underlying assets are ensured by collaborating with third-party data providers and utilizing technologies such as satellite remote sensing, artificial intelligence, and blockchain.

Innovating and Developing Biodiversity-Related Financial Products

Asset managers actively promote biodiversity-related product innovation, balancing their core competencies with optimized market resource allocation. Products such as sustainable-linked bonds, biodiversity loans, special purposed funds, and thematic commingled funds can be introduced by integrating the relevant experience of global asset managers in sustainable financial product innovation. The aim is to support biodiversity conservation and the sustainable use of natural capital. These innovative products enhance the management capabilities of asset managers and high-risk industrial chains by encouraging relevant investments. By directing funds towards projects or companies that protect biodiversity, resources are better allocated, and risks are reduced through the liquidity of the financial market. Additionally, asset managers can incorporate biodiversity risks into investment decisions to further optimize risk management by integrating innovative assessment and screening mechanisms.

Improving Biodiversity Risk Management Systems in Asset managers

Asset managers can improve biodiversity risk management regulations and standards, building a top-level design framework from perspectives such as objectives, standards, processes, and information disclosure. The biodiversity goals are set, conservation strategies are formulated based on the Biodiversity Convention, and there is a commitment to gradually reduce investments in risk-related assets. The “no net loss” or “net gain” principle is adopted to enhance the biodiversity of the investment portfolio. The key biodiversity issues are integrated into the sustainable performance evaluation system. Specialized risk assessment standards are established to provide a basis for financial product design, asset management, and other areas. Internal policies are formulated to define the boundaries of biodiversity impacts in investment and financing, standardizing project evaluation, risk mitigation, and correction mechanisms. Regular assessments and disclosures are made to demonstrate the progress, measures, and effectiveness of risk management to stakeholders, enhancing transparency and accountability.

Building Biodiversity Financial Risk Management Capabilities

Asset managers could enhanced its biodiversity-related capacity through infrastructure development, integration of internal and external resources, and the establishment of core performance framework and indicators. One of the measures is to develop biodiversity stress-testing tools to evaluate impairment risks of asset portfolios under diverse scenarios, identify potential adverse impacts proactively, and adjust allocation accordingly to ensure portfolio sustainability. Also, asset managers could strengthen the integration of internal and external resources by promoting collaboration among departments (investment, research, quantitative analysis, risk management, compliance, etc.) and partnering with research institutions, NGOs, and data providers to improve the professionalism and systems embedded within risk management. Lastly, incorporating biodiversity performance indicators into management and product evaluations would be another measure to take. Asset managers can integrate them into risk management and investment decisions, establish a biodiversity risk management system interoperable with ESG databases by steps, and comprehensively measure the sustainability risks of portfolios through regular monitoring.

Original Article:

Biodiversity Risks in Asset Managers From Theory to Practice.pdf

Biodiversity Risks in Asset Managers From Theory to Practice.pdf

Disclaimer

This document is for reference only and provides information about responsible investment and our company (referring to E Fund Management Co., Limited, hereinafter referred to as "the Company"). This document serves as a general introduction only and does not constitute an offer or invitation to offer, or any recommendation, commitment, implication of returns, or guarantee regarding any purchase or investment. The Company makes no express or implied warranties as to the accuracy, reliability, timeliness, or completeness of this material, nor shall it be liable for any consequences arising from the use of or reliance on this material in any form.

Unless authorized by the Company in writing form in advance, no institution or individual shall distribute, copy, reprint, or publish this document or any part thereof in any form, or make any deletion or modification contrary to its original intent, and shall assume full liability for any consequences arising therefrom. Investment involves risks.