This year, some highly-leveraged real estate developers defaulted on their bonds, casting a shadow on credit bond investing. Certain investors even mistakenly consider credit bonds as a risky investment with low return, yet past experience and current practice show that high-rated credit bonds remain the core holdings of portfolios and play an important role in multi-asset investment.

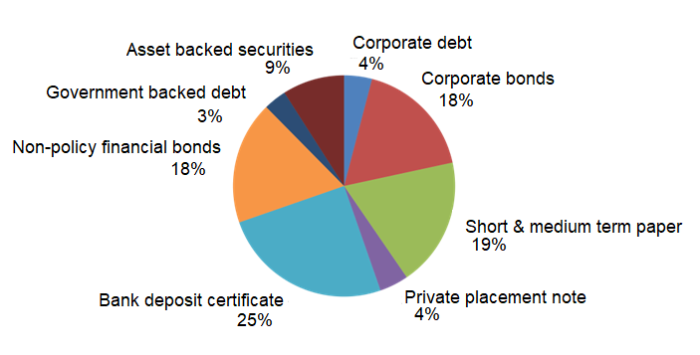

After nearly two decades of development, China’s credit bond market (in the broad sense) records an amount of RMB 55 trillion, representing 43% of the entire bond market and 52% of China’s GDP in 2020. Both the interbank and the exchange-traded credit bond markets have grown significantly and made constant innovations. Now the market covers a wider variety of products, including enterprise bonds, corporate bonds, and medium- and short-term notes, offering much more options for fixed-income investors.

Proportions of Different Domestic Credit Bonds

Source:Wind, as of November 2021.

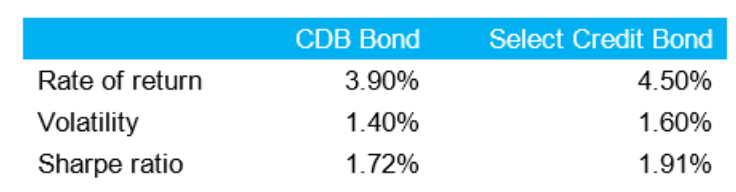

Default on bonds has become less uncommon since 2018, registering an average annual rate of around 1%. The increasingly apparent credit risk does not mean decreasing the investment value of credit bonds, which will remain favored as long as proper credit risk prevention measures are in place. In fact, the situation has highlighted the importance of professional investment research. Based on effective risk control and pricing, credit bonds will continue to be a significant fixed-income asset class. Investors targeting at high-rated credit bonds can receive a decent return and smoothen the net value fluctuations of the portfolio, achieving a satisfactory Sharpe ratio.

Take ChinaBond Select Investment Grade Credit Bond Index, for example. The index is composed of selected credit bonds that are publicly offered and traded in China with a ChinaBond market implied rating or an issuer credit rating of AA+ or above, which cover most of the high-rated credit bonds on the market. The index has achieved a stable long-term Alpha, posting an annualized yield of 4.27% in the last 5 years, 4.48% in the last 3 years, and 4.46% from the beginning of this year.

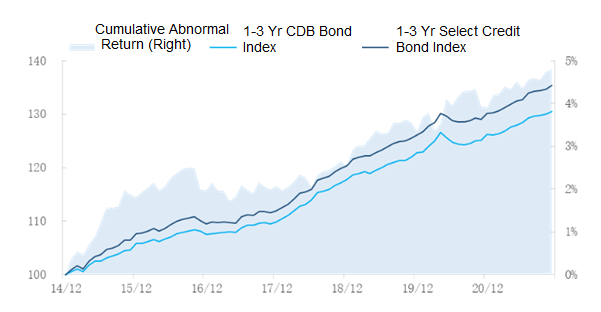

The graph below shows that the index has outperformed the 1-3 Year CDB Bond Index by 4.8% in total, averaging an Alpha of 0.69% each year with limited drawdown.

ChinaBond Select Credit Bond Index vs. 1-3 Year CDB Bond Index

Source: Wind, from January 2015 to November 2021 on the basis of monthly data (index on 2014/12/31 = 100).

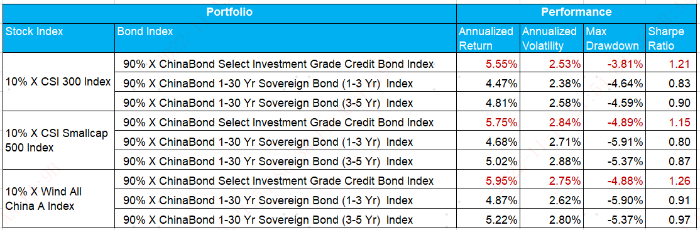

For a hybrid fund, stocks and bonds are two fundamental asset classes. Bonds not only generate the basic investment return, but also hedge against fluctuations in the equity market to some extent and smoothen the net value curve of the portfolio. It is calculated from historical data that, in hybrid products that include equities, credit bonds outdo rate or govern-backed bonds in buffering stock price fluctuations and improving overall performance thanks to their stable returns. Specifically, a portfolio that allocates 10% to stocks, whether of the CSI 300 Index, CSI Smallcap 500 Index, or Wind All China A Index, and 90% to the bonds of the ChinaBond Select Investment Grade Credit Bond Index, always achieves higher annualized rate of return and better Sharpe ratio and Calmar ratio than one that allocates to rate bond indexes.

Calculated Performance of Stock/Bond Portfolios

Note: Data from January 2013 to November 2021.

China’s credit bond market and multi-asset investing presents greater potential in the long run. We still consider high-rated credit bonds a core asset class for fund accounts. For multi-asset fund accounts, we will continue to improve our capability of credit investment research and asset allocation and follow market trends closely to offer investors more robust returns.